December 20, 2019 | Industry Insights

Limits of Liability for Air Carriers Set to Increase

Increase Expected for Limits of Liability Established by the Montreal Convention

In a message to members of the Airforwarders Association, Regulatory Compliance Committee Chairman Bob Imbriani states,

“The liability for international air cargo (Montreal Convention) is increasing from 19 to 22 SDR per kilo effective December 28, 2019.

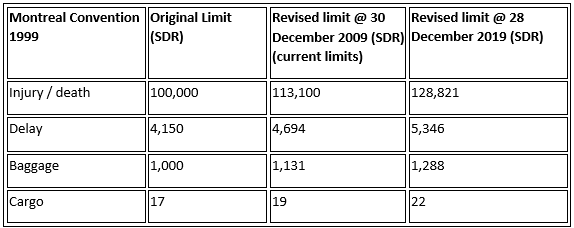

The International Civil Aviation Organization (ICAO) has proposed a 13.9% increase to the Montreal Convention’s liability limits following completion of its quinquennial review. The increase is based on the accumulated rate of inflation (weighted by reference to the average Consumer Price Indices of the United States, Japan, China, European Union and the United Kingdom) since 2008, when the last adjustment was made. This means that the current limits of liability will be adjusted as follows:”

Air freight forwarders and indirect air carriers are encouraged to continue current best practices when it comes to their transportation insurance policies. Procuring shipper’s interest cargo coverage for your clients on each and every shipment is still the best way to ensure that losses to goods are covered. The increased air carrier limits of liability will not suffice to meet the potential cost of loss in most cases, and the need to prove carrier negligence remains a concern that cargo insurance alleviates. The need to maintain your own liability coverages of course does not change with the carrier limits either.

However, some changes to current documentation and procedures may be necessary. Airforwarders Association Chairman Imriani explains,

“While the liability of the actual air carrier will increase it can also have an effect on the limits of a Freight Forwarder/Indirect Air Carrier who issues their own airway bills and generally mirror the terms and conditions of the actual air carrier. It is important that all members who issue their own airway bills check their terms and conditions and any carrier’s liability coverage they may have to determine what change they may feel are required.”

Details of the change to the Montreal Convention limits of liability can be viewed at the ICAO website.

Please don’t hesitate to contact your local Roanoke Insurance Group team with any questions you may have about this change or to discuss the right coverages for your business.