April 13, 2023 | Commercial Business Insurance, Industry Insights

Is your Business Exposed to the Risks of Employee Distracted Driving?

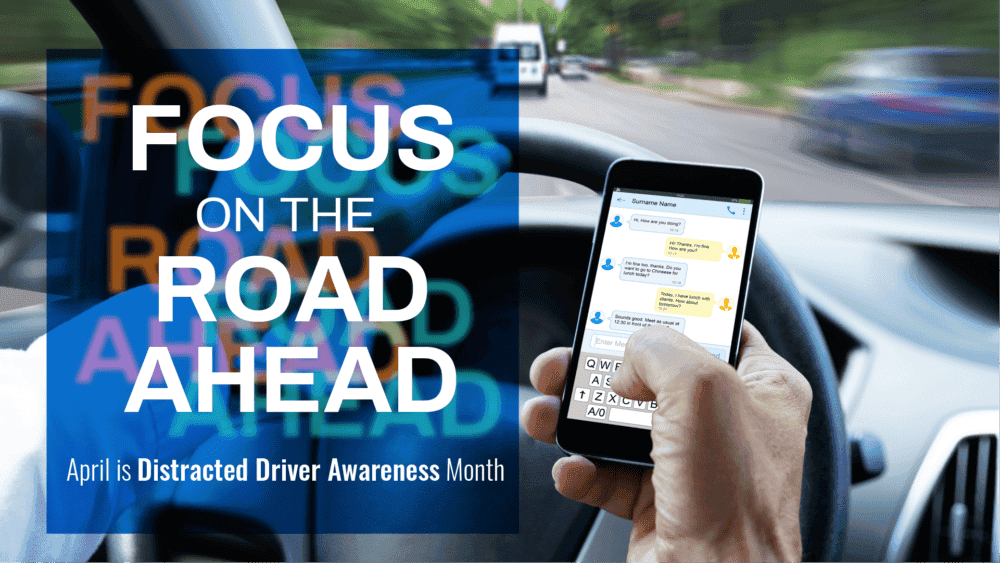

The National Safety Council(NSC) recognizes April as Distracted Driving Awareness Month. They estimate that 4,000 deaths and 276,000 injuries occur yearly because of distracted driving crashes. Additionally, distracted driving is the cause of 10% of all fatal crashes.

Many of these accidents and fatalities are attributed to drivers engaging in risky behavior such as cell phone use, eating/drinking, reaching for an object, talking to a passenger or reading GPS. Not wearing seatbelts, speeding and use of alcohol makes these accidents much worse. Additionally, the stressors of the pandemic, returning to work, and other social factors have increased the cognitive distraction of individuals even when not engaging in risky behaviors noted previously.

Distracted driving poses a significant risk to every business with employees who drive for company business, even if the vehicles aren’t company-owned. Under the doctrine of vicarious liability, employers may be held legally accountable for negligent acts employees commit during their employment. Employers may also be found negligent if they fail to implement a policy for the safe use of cell phones.

There is a strong relationship between distracted driving and other fleet safety elements such as driver training, overall fleet safety program implementation and enforcement, routing and logistics, and telematics use. Therefore, Distracted Driving Awareness Month is an excellent opportunity to initiate conversations within your organization about how to combat driving distractions.

Our partners at CNA have prepared a Risk Control Guide to assist businesses in developing a program that helps enhance driver behaviors and reduce cell phone-related distractions, such as talking and texting. Download it below.

Roanoke offers our clients essential commercial business insurance solutions through an exclusive program with CNA. CNA, backed by more than 125 years of experience, is one of the largest commercial property and casualty insurance companies in the U.S.

Please get in touch with us today to learn more about Roanoke’s commercial business insurance solutions.

Disclaimer: This information is provided as a public service and for discussion of the subject in general. It is not to be construed as legal advice. Readers are urged to seek professional guidance from appropriate parties on all matters mentioned herein.