October 13, 2014 | ATA Carnet

How the new Foreign Trade Regulations (FTR) Export Requirements Impact ATA Carnet

| Starting April 5, 2014, several changes will be implemented to the U.S Census Bureau Foreign Trade Regulations (FTR). Some of these changes involve goods leaving the U.S. under an ATA Carnet. All exports leaving the United States, except temporary exports, have historically required Electronic Export Information (EEI) filing. However, the types of exemptions that exist today will be greatly curtailed effective April 5, 2014. These changes greatly affect ATA Carnet shipments, as they cover both U.S. issued ATA Carnets and foreign ATA Carnets used for temporary importation into the U.S.

Narrowing the temporary export exemption ATA Carnet exemptions

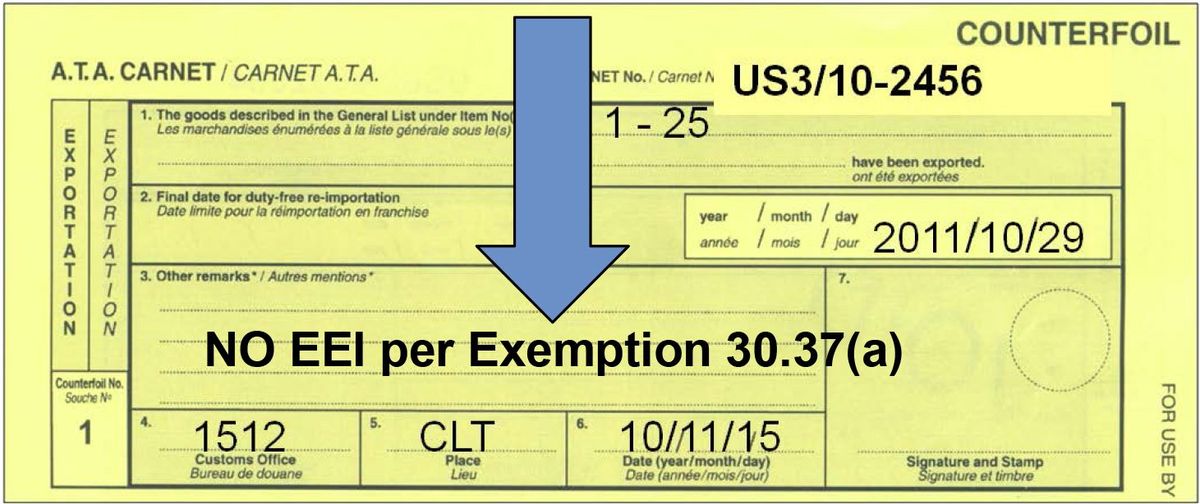

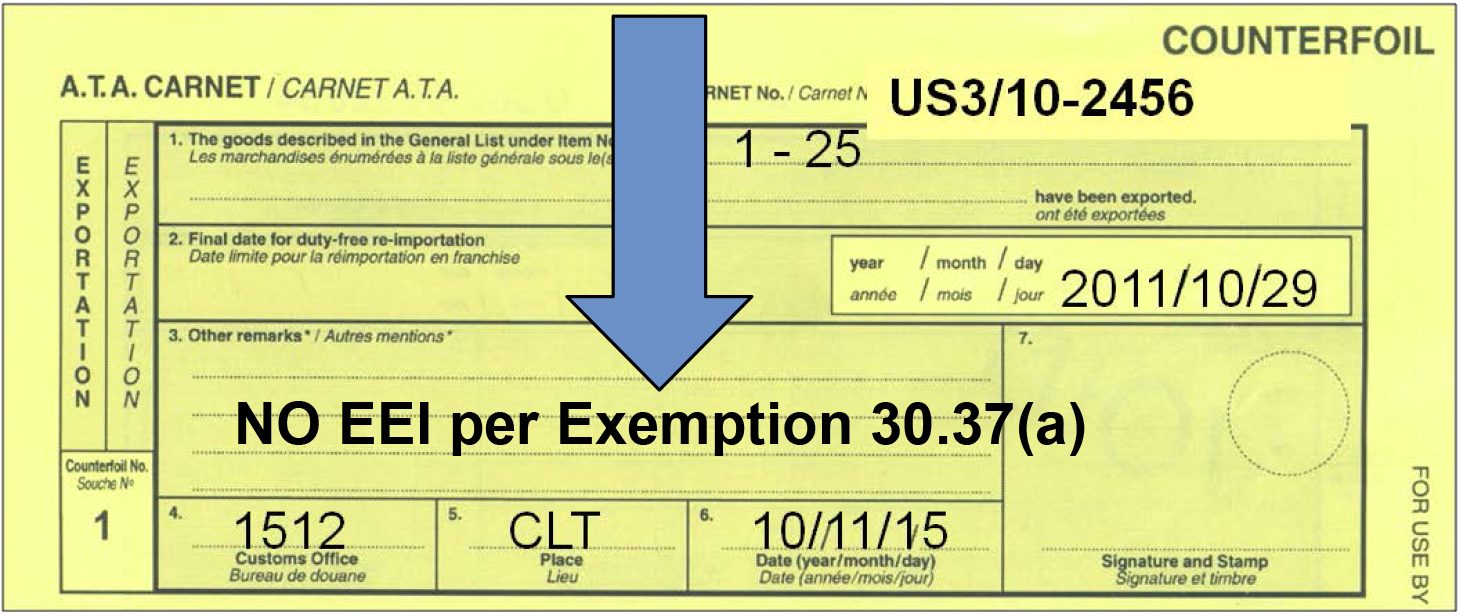

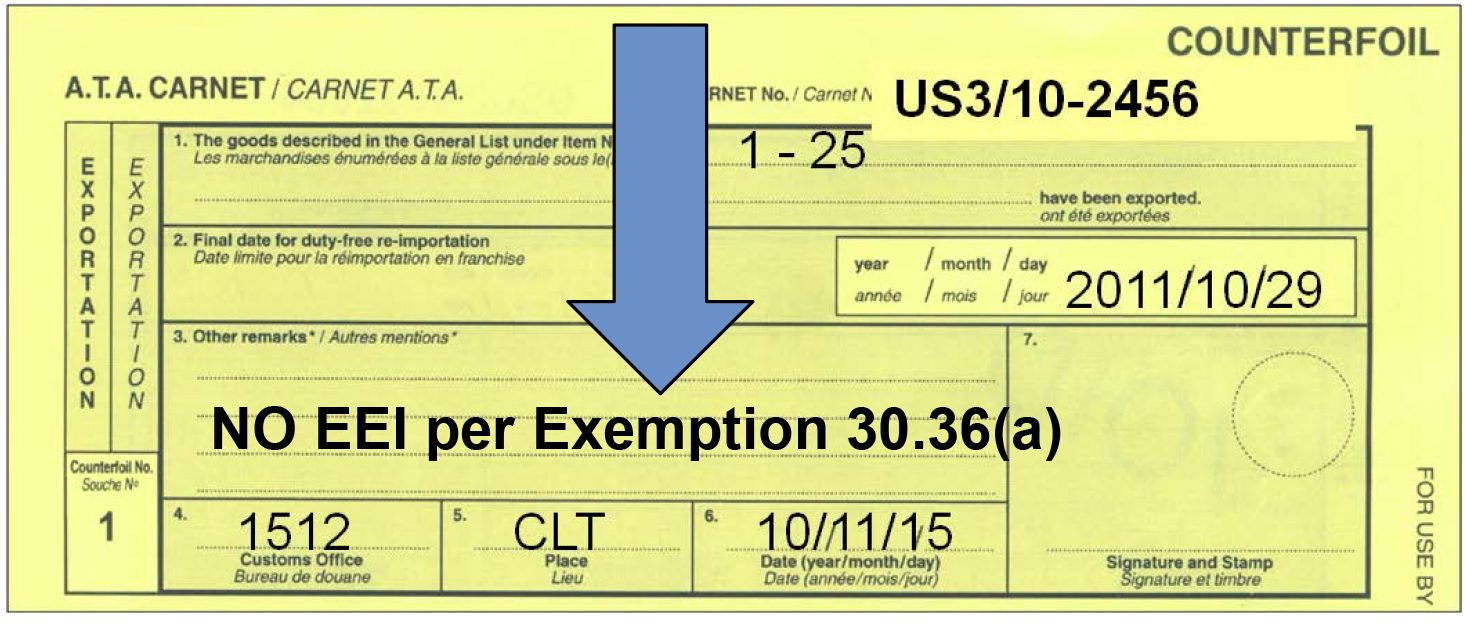

This exemption needs to be recorded on the yellow exportation counterfoil in box 3 for “Other remarks” as: NO EEI per Exemption 30.37(a) |

|

The ATA Carnet and its goods must meet all of the following conditions to qualify for this exemption:

This exemption only applies to U.S.-issued ATA Carnets. Foreign ATA Carnets that are being hand carried must still fulfill the EEI filing requirement if any Schedule B number’s total value exceeds $2,500. For items traveling with an export licenses certain restrictions still apply. (see 15 CFR 740.9). To benefit from the Hand Carried Tools of the Trade exemption, enter into box 3 for “Other remarks” the following: NO EEI per Exemption 30.37(b) |

|

Export Licenses: new requirements for goods subject to export licenses on ATA Carnet ATA Carnet Interpretation for EEI filing in AES The following list will help you complete some data requirements in AES. These are not all the required and conditional fields, but rather those which require interpretation for ATA Carnet shipments.

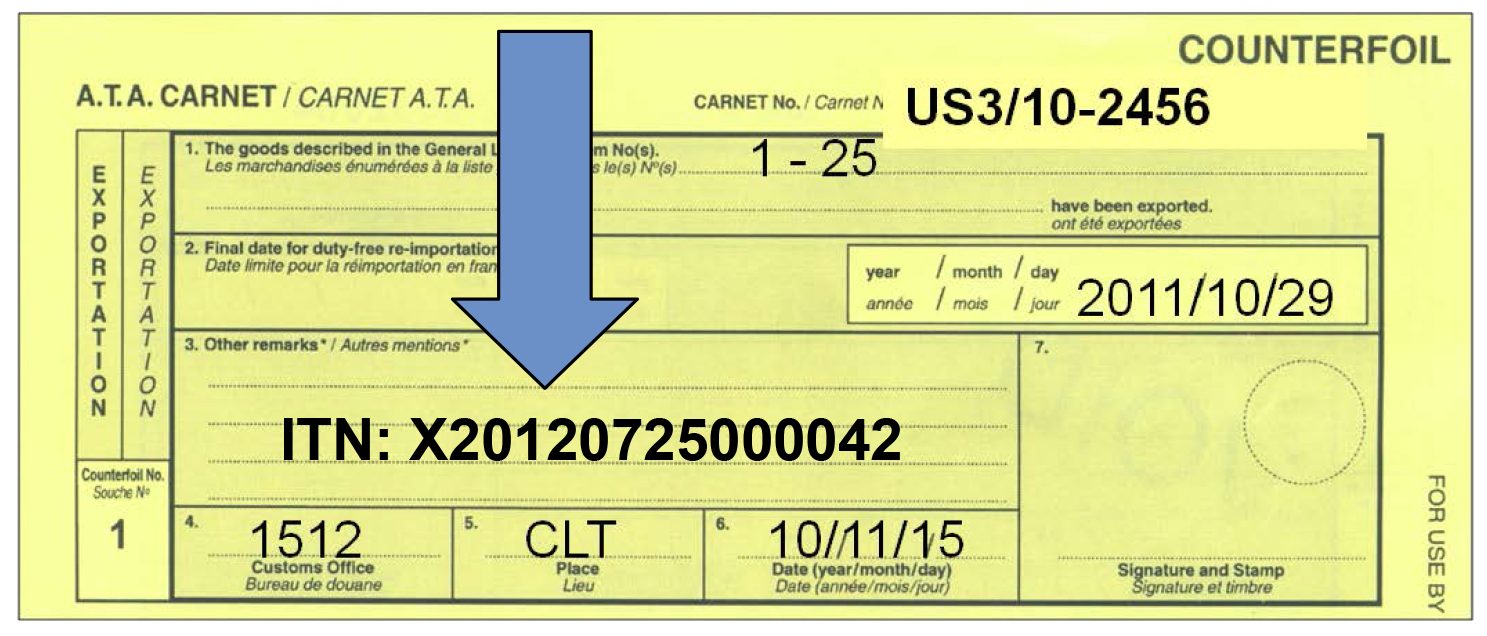

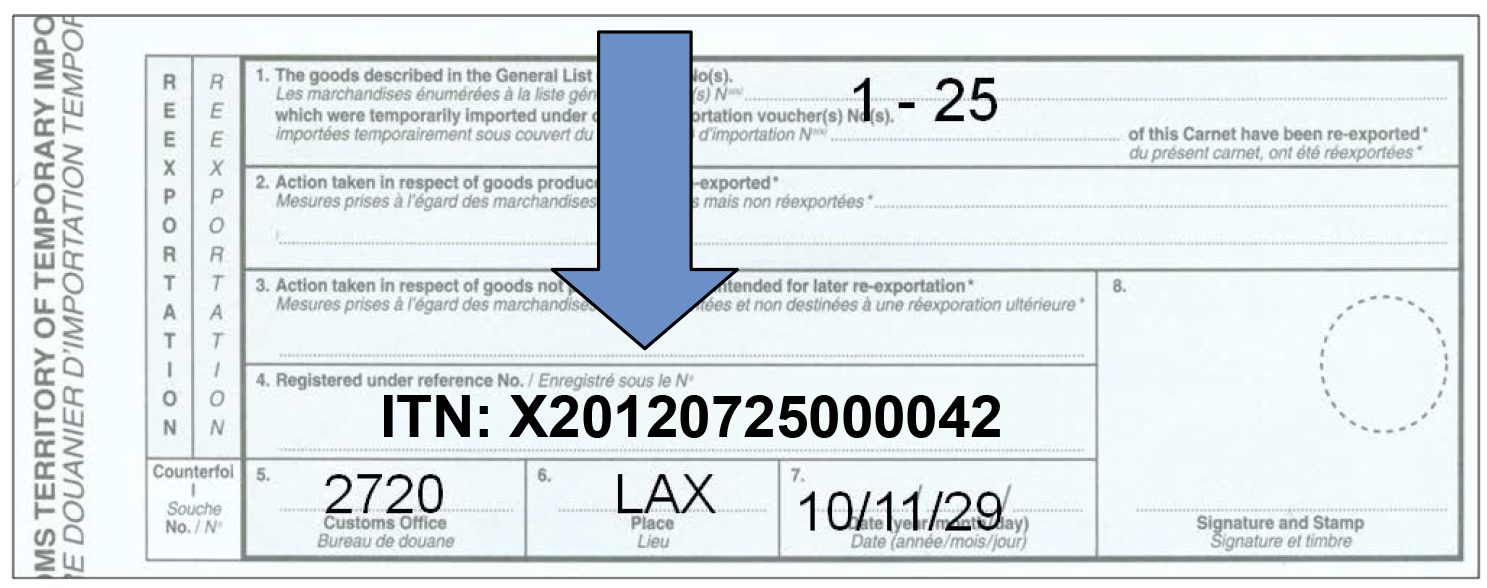

Once the EEI filing is submitted, you will receive an email confirmation containing your unique Internal Transaction Number (ITN). This must be recorded on the exportation counterfoil in the box 3 for “Other remarks” (U.S. ATA Carnet) or box 4 “Registered under reference No.” (foreign ATA Carnet). |

| U.S. ATA Carnet example

|

| Foreign ATA Carnet example

Penalties There are a number of changes to the Foreign Trade Regulations, especially how terms are defined and how information is to be reported. Roanoke strongly encourages all exporters to be familiar with laws and regulations governing the movement of goods. The U.S. Census Bureau’s Foreign Trade Division’s website is an excellent resource for information. Census will also accept questions by phone (1.800.549.0595) or email regarding how the laws and regulations apply to your situation. |

|

This information is provided by Roanoke Trade, a division of Roanoke Insurance Group Inc. as a public service and for discussion of the subject in general. It is not to be construed as legal advice. Readers are urged to seek professional guidance from appropriate parties on all matters mentioned above. Insurance and surety risk management solutions for supply chains and transportation have been Roanoke Trade’s focus since 1935. Roanoke Trade is a subsidiary of Münchener Rückversicherungs-Gesellschaft (Munich Re) and an affiliate of Munich Re Syndicate, Ltd. Roanoke Trade closely follows the ever-changing government policies that affect the movement of goods, and works only with insurance companies financially rated as “A-” (Excellent) or better. |